You’ve figured out that you have mineral rights—now what? Should you:

a) Sell them

b) Lease them

c) Do nothing

The answer: it depends.

Value

The first three rules of mineral valuation are the same as the first three rules of real estate: location, location, location. Simply put, some underground minerals are far more valuable than others because of the presence of large quantities of hydrocarbon resources like oil and natural gas. Some areas are resource-rich, while other areas contain very few resources. A single acre of mineral rights might be worth $5,000; $10,000; or even $20,000 in a resource-rich area, while an acre just a couple miles away may have little to no value.

Should I sell my minerals or lease them?

The decision to sell your mineral rights or to lease them will depend on a few factors.

First, who is interested in buying them or leasing them? Lots of different types of companies—oil & gas exploration companies, mineral investment companies, private equity firms, and others—buy minerals. A private equity firm, for example, may want to buy your minerals as a long-term investment even though no oil and gas company is going to extract oil and gas in the coming months or years. An oil & gas exploration company, on the other hand, may want to buy the minerals so they can access the resources contained within them and keep 100 percent of the profit from them. Alternatively, the same company may simply want to lease the minerals from you so that they may extract the resources and share the profits with you without having to buy the minerals up-front in one lump sum.

Second, what are your financial priorities? Selling mineral rights can often provide the seller with a nice, one-time payment for the purchase. Let’s say you own 10 acres in a valuable area… you may be able to sell your minerals for $15,000 per acre, netting you $150,000. But is that the best decision? Maybe. You might instead be able to lease your minerals to an oil and gas company. In doing so, you can negotiate a lease bonus—a one-time payment for leasing your minerals whether the company ever extracts resources or not—as well as receive royalty payments if-and-when the company extracts resources. You might receive a $10,000 lease bonus, then receive an average of $5,000 per month in royalty payments for the next several years, ultimately exceeding the $150,000 you would get for selling the entirety of the mineral rights.

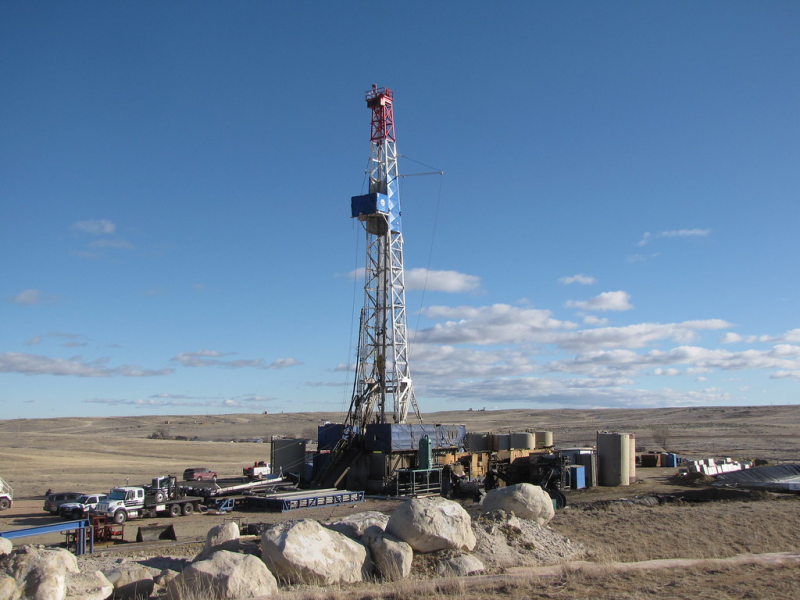

Third, how much industry activity is there in your area? If there is lots of oil and gas development in the area where you own minerals, there is a higher chance that someone will want to extract resources from your minerals in the near future. Nearby industry activity may also be an indicator that your minerals are in a valuable area and that someone may actually be interested in buying or leasing them.

Is doing nothing an option?

Choosing not to sell or lease your minerals is certainly an option. If your minerals are in a prolific or valuable area, however, it would be financially unwise not to sell or lease them.

Some states have mineral pooling laws that will allow an oil and gas exploration company to access your minerals and pay you for them, even if you have not leased the minerals to them. The payments, however, will be smaller than they would be if you negotiate with the company, and you also will not receive a lease bonus.

Navigating the sale of mineral rights can be complex, and it isn’t something most people know very much about. But there’s good news… Meagher Energy Advisors can help! Reach out to us at (303) 721-6354, and we would be happy to discuss your options with you.